How does your credit score impact your insurance premiums for auto in Utah? Absolutely. And drivers from Salt Lake City could be paying substantially higher or lower based on their credit history.

When people consider the factors that affect their insurance premiums, they envision incidents, traffic violations, or the model of car they own. In Utah, as in several other states, your credit score is a significant factor in the price you have to pay.

Many Utah drivers don't realize the fact that their credit history may result in them paying hundreds or even thousands of dollars each year for auto insurance.

This article explains the importance of your credit score and how it impacts your car insurance rates across Salt Lake City and across Utah and also how you can boost your rate. Understanding these factors is crucial, especially when considering vandalism coverage options that might also be affected by your credit history.

Why Do Car Insurance Companies Use Credit Scores?

On first look it may appear to be unrelated to your driving habits. Insurance companies, however, assert that there's the statistical correlation between scores from insurance companies based on credit, and the possibility of submitting claims.

Simply put, those with better credit scores are considered to be more secure to take on insurance. This is why a motorist with an outstanding record, but low credit score could cost more than someone who has some traffic tickets, however a good credit score.

Insurance firms located in Utah utilize"credit-based insurance scores" in Utah "credit-based insurance score", that's not exactly the same as the score that lenders use to make loans. The score still has similar components like:

- History of payments

- Credit utilization

- The length of the credit history

- Credit types utilized

- Recent inquiries: a number of

Using Credit Scores to Determine Insurance Rates is Legal in Utah?

Yes. In Utah insurance companies can legally use credit-based scores in determining rates for automobile insurance. Based on the National Association of Insurance Commissioners (NAIC) approximately 95 percent of car insurers utilize credit data in some way.

Certain states, such as California, Hawaii, and Massachusetts prohibit this type of procedure completely. But Utah lets it happen, meaning your credit score could reduce your costs or increase the rates more expensive, based upon where you are within the range.

How Much Does Credit Score Affect Car Insurance in Utah?

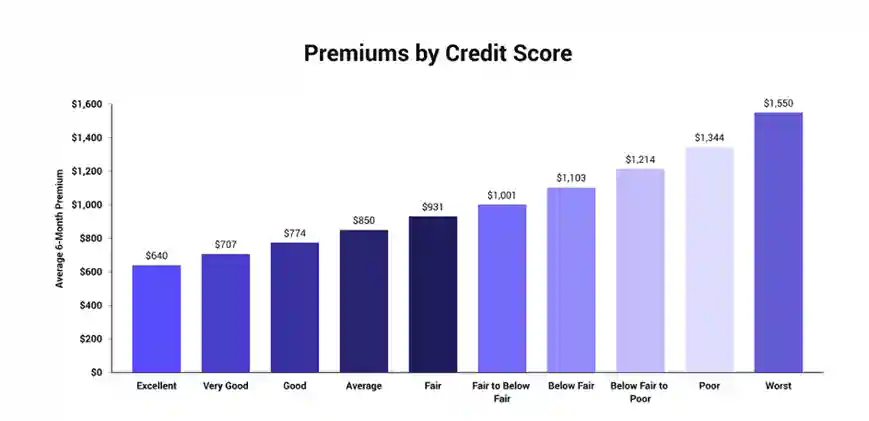

Research shows that credit score could significantly impact the cost of car insurance for Salt Lake City and other Utah cities. In a 2023 study from The Zebra:

Good Credit

$1,100

AnnuallyAverage Credit

$1,400-$1,600

AnnuallyPoor Credit

$2,300+

AnnuallySalt Lake City Auto Insurance Rates by Credit Score

| Credit Tier | Average 6 Mo. Premium |

|---|---|

| Very Poor | $1,655 |

| Fair | $934 |

| Good | $765 |

| Very Good | $689 |

| Exceptional | $605 |

This is true regardless of the history of accidents, age or even driving patterns. This means that drivers with poor credit are often subject to the highest fines, even though they've taken all the right precautions when they're behind the wheel.

If you're currently in this position It's crucial to research the options available and examine the cost of car insurance for Salt Lake City carefully so that you don't overpay.

Why Does Credit Score Affect Car Insurance in Utah?

Credit scores, according to insurance companies, are reliable due to their correlation with the behavior of claimants. Statistically:

- Drivers with better credit ratings tend to be less likely to file claims.

- If they have, their claims will be less costly.

- The people with lower credit scores are more likely to make more claims and are more costly claims.

Although this isn't always a reflection of the individual driver's habits Insurance companies depend on aggregated information as well as risk-based modeling to help guide pricing.

But, advocates for consumers argue that credit could unfairly penalize people who are experiencing difficulties with finances, especially during job loss and medical emergencies or short-term drops in earnings.

Can You Be Denied Insurance in Utah for Bad Credit?

No. Utah laws prohibit insurance companies from refusing insurance coverage solely due to an unsatisfactory credit score. But, they are able to:

- Increase the cost of premiums

- You will need a larger down payment

- Offer fewer discount options

Additionally, if you permit the policy to expire or fail to make a payment, it affects both your insurance coverage as well as your credit score. This can result in the creation of a negative cycle, which is hard to get out of.

How to Improve Your Credit and Your Premium

Good news? Your credit score won't be fixed forever. Achieving a better credit score could result in lower rates on insurance in the future. Here are a few smart ways to begin:

Pay Bills on Time

History of payments is the primary element. Create autopays or reminders so that you don't miss the due date.

Lower Credit Utilization

Make sure you use no more than 30% of the available credit. The process of paying down credit cards could instantly boost your score.

Avoid Hard Inquiries

In the event that you apply for too many loans or credit cards over an unintentional time frame can decrease your credit score.

Check Credit Reports

Check for mistakes or old negatives. It is possible to dispute inaccurate data with credit bureaus.

Other Ways to Save on Car Insurance in Utah

As you improve your credit score, you can still lower your interest rates for Salt Lake City:

- Bundle home and auto insurance to get discounts on multiple policies.

- Learn defensive driving to be eligible for rate reductions.

- Install anti-theft and safety gadgets in your vehicle.

- Make use of telematics apps that reward the safe behavior of drivers.

- Find out about discounts for low mileage If you don't travel often.

Also, make sure to take your time and shop at different prices. Prices can vary greatly between companies as well as loyalty may not provide savings.

When Should You Re-Purchase Your Insurance Policy?

A lot of drivers remain with the same company for a number of years, regardless of whether their credit has improved. This is a mistake.

The policy should be reviewed at least every six to twelve months, and especially when:

- The debt has been paid off or improved your credit score

- You've had no recent claims

- You've relocated to a new ZIP area

- You've included safety options or modified your vehicle

Finding new quotes once your credit has improved can aid in saving the cost of.

Final Thoughts

Your credit score may not be a reflection of how safe you travel, but in Utah the score plays significant roles in determining the cost of insurance. This understanding can help to take charge of not only your credit score, but of your financial situation on the road.

By preparing and smart shopping for policies, as well as credit restoration, you'll change from a high-risk customer to a preferred customer and benefit from the reduced costs that go along with the move.