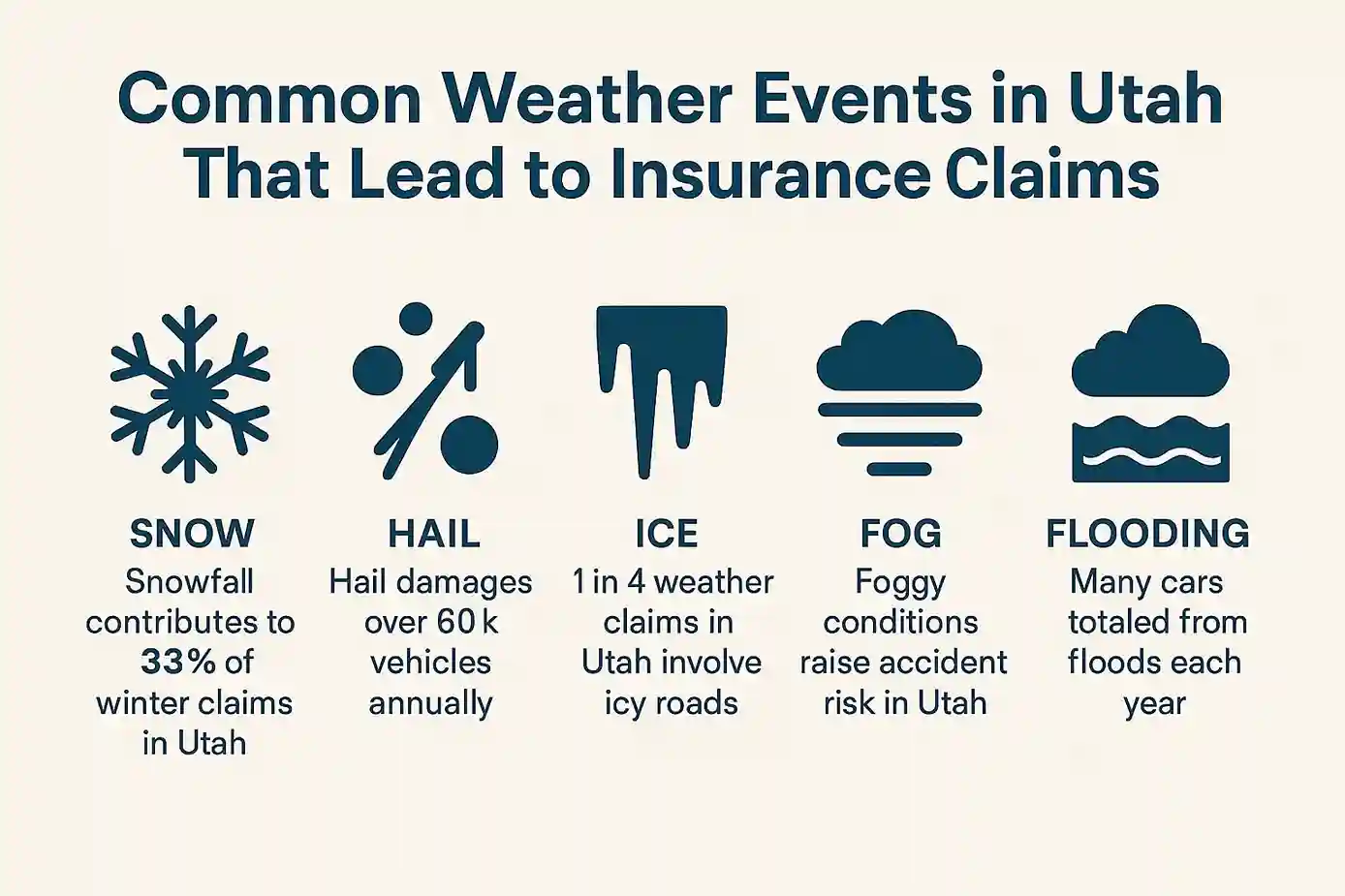

Conditions in the weather are a major factor on the amount of car insurance claims that are filed for Utah. Sometimes, severe weather phenomena like rain, snow and snowy roads can cause a rise in the amount of weather-related car collision insurance claims.

The weather in Utah is as varied as the landscape it covers, from mountainous canyons covered with snow in the north, to scorching deserts to the south. If you're in Salt Lake City or nearby regions, chances are you've had the experience of snowstorms in winter, hail flash floods or even smoke from wildfires. These weather conditions do more than alter your daily commute.

The weather's conditions affect the car insurance coverage you have in the claim process, as well as the cost of premiums.

In this piece we'll discuss how weather-related incidents within Utah influence claims on car insurance as well as the kind of insurance you'll need as well as how you can plan for an unexpected event.

Does Weather Affect Car Insurance in Salt Lake City, Utah?

Absolutely. Weather has a significant and significant role in how the insurance system works for car owners who reside in Salt Lake City. Insurance companies monitor local claims data carefully, and in Utah, which is a place where extreme weather conditions are not uncommon, incidents involving weather frequently result in a rise of collision and comprehensive insurance claims.

The city of Salt Lake City, the combination of massive snowfall as well as hailstorms that are sudden as well as flash floods that occasionally occur create conditions that raise the risk of car damage, even when motorists are not at the wheel. It doesn't matter if it's a damaged windshield caused by hail, flood damages from storm drains that are backed up or a damaged bumper due to sliding across slippery roads, these situations are all a cause for insurance claims which can impact the cost of your insurance.

Though not every weather-related incident can increase your premium, the repeated filing of claims or being in a ZIP code that is high-risk could increase your costs as time passes. Insurance companies may also alter rates by location based on the amount and severity of claims that are filed at certain periods of the year, for example weather or winter.

That means, even if you're an experienced driver, the weather in your local area--and the frequency at which other drivers in the area make claims can affect the amount you'll have to pay for insurance.

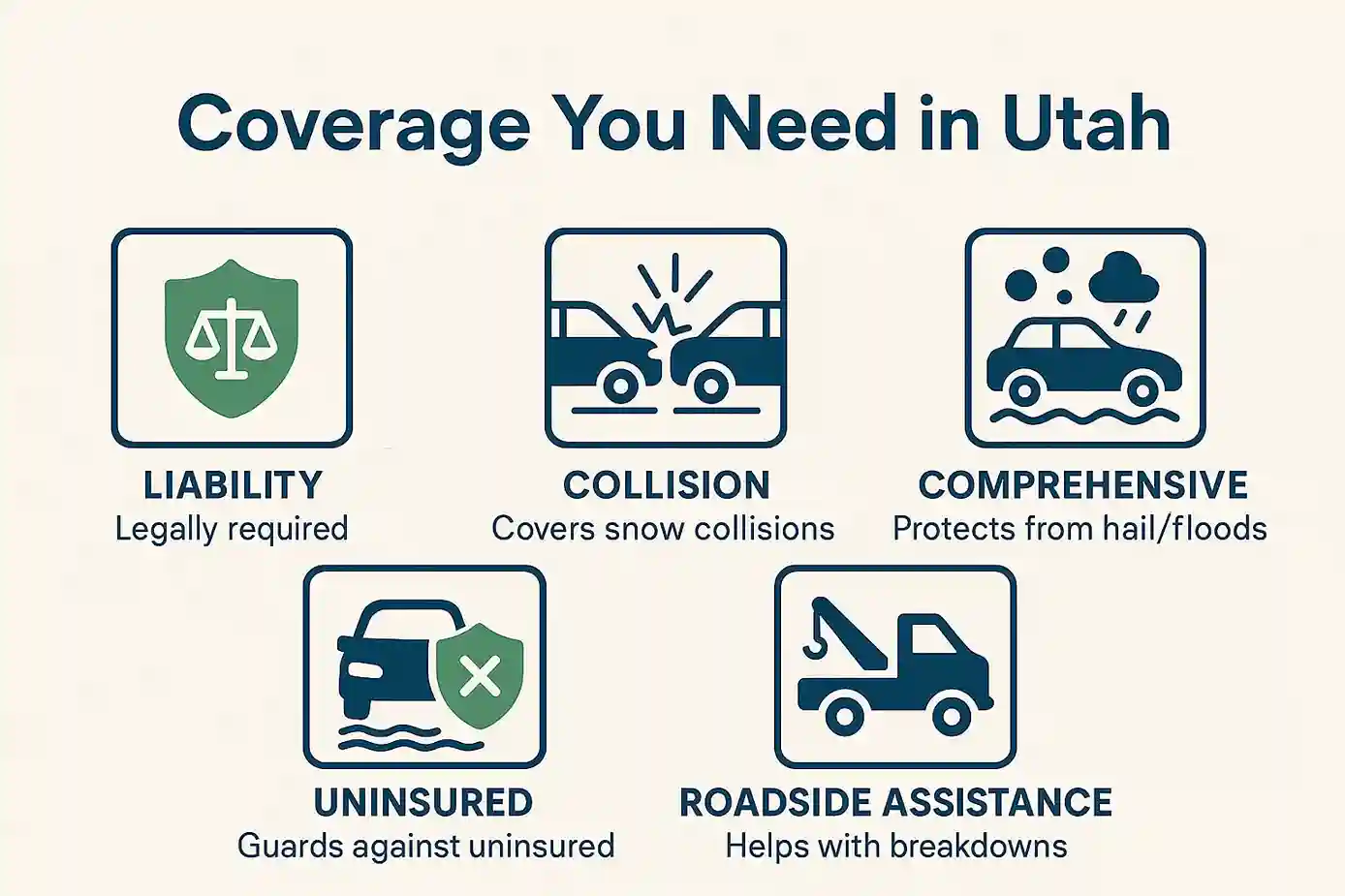

It is possible to get greater protection through reviewing the various insurance options for your car within Salt Lake City and making sure that the policy you choose is compatible with the unpredictable weather in Utah.

We'll take a review of how the weather impacts car insurance coverage as well as insurance claims within Salt Lake City, Utah.

1. Utah's Climate and Insurance Risk

Utah is a place that experiences a range of extreme weather:

- A lot of snow falls during winter particularly in the Wasatch Front

- In the spring and summer seasons

- The flash floods are common in low-lying regions as well as canyons

- Smoke and wildfires can be seen in the hot and dry.

Natural hazards like these can increase the number of automobile claims, particularly comprehensive coverage claims. This affects individual insurance premiums as well as general market prices within the state.

2. Snow and Ice

Northern Utah can mean roads that are icy, less visibility and an increased chance of accidents. According to the Utah Department of Public Safety:

- More than 18,000 crashes every year In Utah result from snow, slush or snow or ice.

- The majority of them occur within areas like the Salt Lake City area between November and March.

What does it mean for the insurance you have:

- Sliding or skidding are covered under the collision insurance.

- The damage caused by fallen tree branches or snow-laden debris are insured by extensive insurance.

- If you're deemed to be in the wrong Your liability coverage will be in place to protect the other party.

Tips: Maintaining regular maintenance of your tires, wearing winter tires and taking care when driving can help avoid claims, and help keep your rates steady.

3. Hail Damage: A Costly Springtime Surprise

Although they aren't as common as in the Midwest and Midwest, hail storms in Utah are prone to causing serious damages. Actually, Salt Lake City saw numerous insurance increases related to hail during the last few years, and certain storms created millions of automobile-related insurance claims within one day.

What's covered:

- Broken windshields and hail dents are protected under a comprehensive insurance.

- If you carry only insurance for liability, or only minimum protection the hail damage won't be refunded.

Quick Tip: Parking your vehicle in covered garages or under carports during storms can help avoid a deductible-triggering claim.