What Is the Minimum Car Insurance Required in Utah?

Utah automobile insurance requirements are described as 30/65/25. Utah as with every other state is able to set its own minimal car insurance requirement. If you are the owner of your vehicle within Utah this is the basic coverages that you must have to legally drive:

- $30,000 bodily injury per person

- $60,000 bodily injury per accident

- $25,000 property damage liability

- $3,000 Personal Injury Protection (PIP)

Utah is a no-fault state. Your PIP helps cover medical costs regardless of who caused the crash and can include some lost wages and essential services. While the minimum allows you to legally drive, it often falls short in real-world accidents.

Minimum vs. Full Coverage: Quick Pros & Cons

Minimum Coverage

- Lowest legal cost to drive

- Includes liability and PIP (no‑fault)

- No protection for your car

- Risk of paying out‑of‑pocket above limits

Full Coverage

- Includes collision and comprehensive

- Better financial protection for new/financed cars

- Higher premium but fewer surprise costs

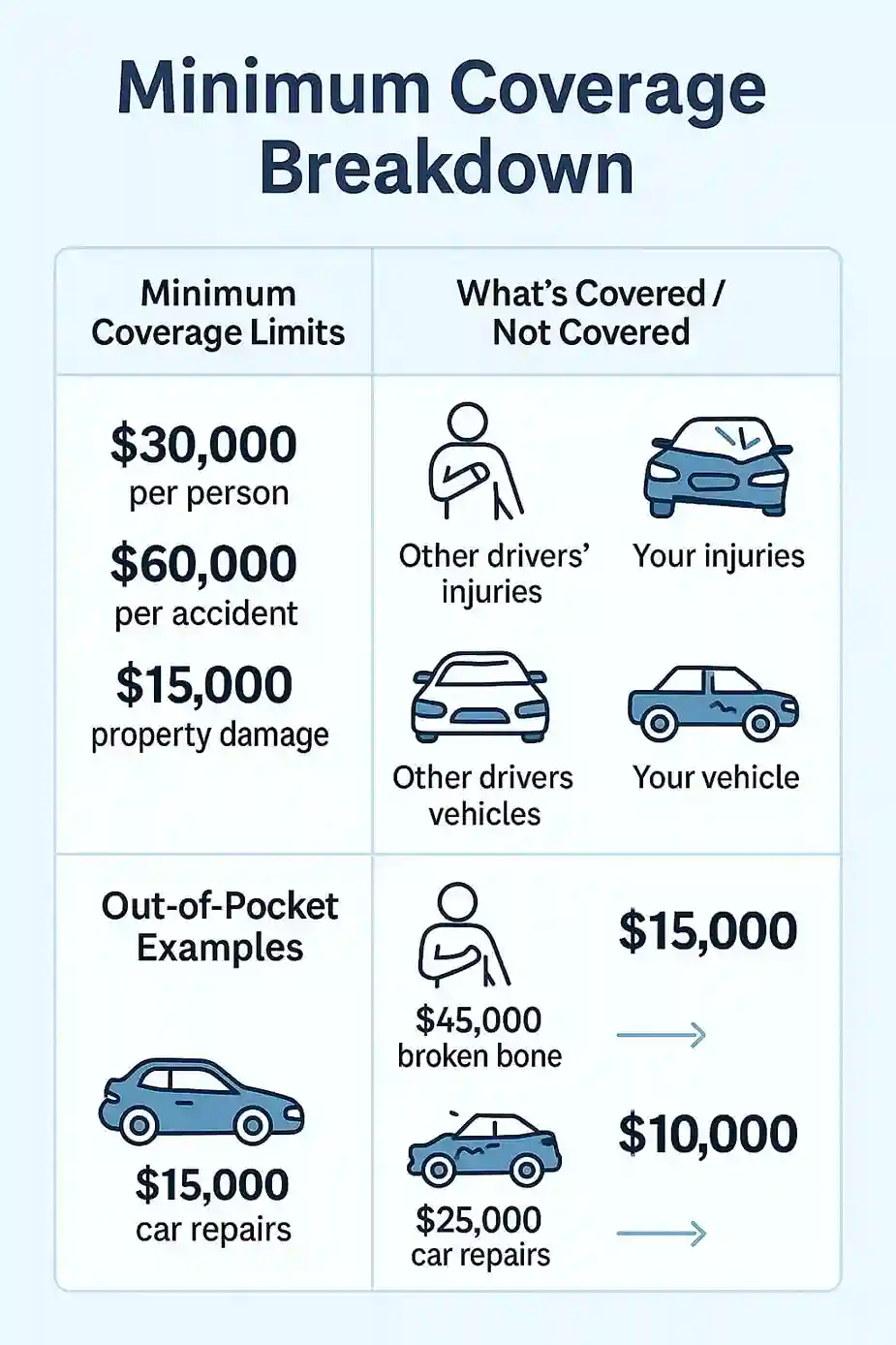

What Does Minimum Coverage Actually Pay For?

Utah changed its auto insurance rules in January 2025. The requirements were little increased, aligning them with the requirements of other states. currently required. Liability-only insurance in Utah implies that the insurance you purchase will cover only the damage caused by you to other people, not the vehicle you drive in or any of the injuries you cause.

This means A bodily injury insurance policy of $30,000 per person is the highest amount the insurance company will cover injury to one person caused by an accident. This is what's covered by minimal protection:

- Bodily injury liability: Medical expenses to others in the event that you're the one to blame

- Property Loss Liability: Damage to a person's vehicle, or property

- PIP: You pay for your own expenses for medical treatment following the crash

However, here's the thing that's not covered:

- Repairs to your own car (without collision/comprehensive)

- Theft, vandalism, hail, flood, fire (without comprehensive)

- Animal strikes (without comprehensive)

- Rental reimbursement and towing (without add-ons)

- Passenger injuries beyond policy limits

Salt Lake City Driving Snapshot

Real Costs of Accidents in Salt Lake City

Salt Lake City has become one of Utah's most crowded metropolitan cities. With a high volume of traffic storms, snowstorms, as well as the increasing number of cars, accidents could cost a lot of money. What are the most typical costs following an accident could take on:

- Bumper-to-bumper repair: $2,500–$5,000

- Visit to the emergency room: $3,000–$6,000

- Total replacement cost for the vehicle: $15,000+

- Costs of legal representation if sued: $10,000+

The limit of $30,000 for bodily injuries may cover the cost of medical treatment just for one person, however no more than one person, nor long-term rehab or surgical procedures. The $25,000 property damage insurance is less than the typical cost of the purchase of a brand new vehicle.

The Risks of Relying Only on State Minimums

Although the minimum might be the most cost-effective upfront investment, it could leave your financial situation vulnerable. What could happen is:

- You Pay Out of Pocket: If the damages are greater than your insurance's maximum limits, you're to pay the balance.

- No Coverage for Your Own Car: If your car is damaged, keyed or lost during a storm, you'll be left with the cost without insurance coverage.

- Insurance is not protected against drivers with no insurance: Utah is among the 20 top states with respect to driver's without insurance.

When Is It Smart to Upgrade Minimum to Full Coverage?

The minimum may be appropriate if:

- If you own an older car which has little value for resale

- Only occasionally do you need to drive

- It is possible to afford the replacement or repair your vehicle without having insurance

However, for the majority of Salt Lake City drivers, the full coverage or greater limit of liability makes more sense. Consider upgrading if:

- Everyday you drive along I-215 or I-80

- If you own a brand new vehicle, whether leased or purchased

- There's no way to pay for large expenses for repairs out of pocket or legal charges

- You reside in a region that is prone to vandalism, theft or hail

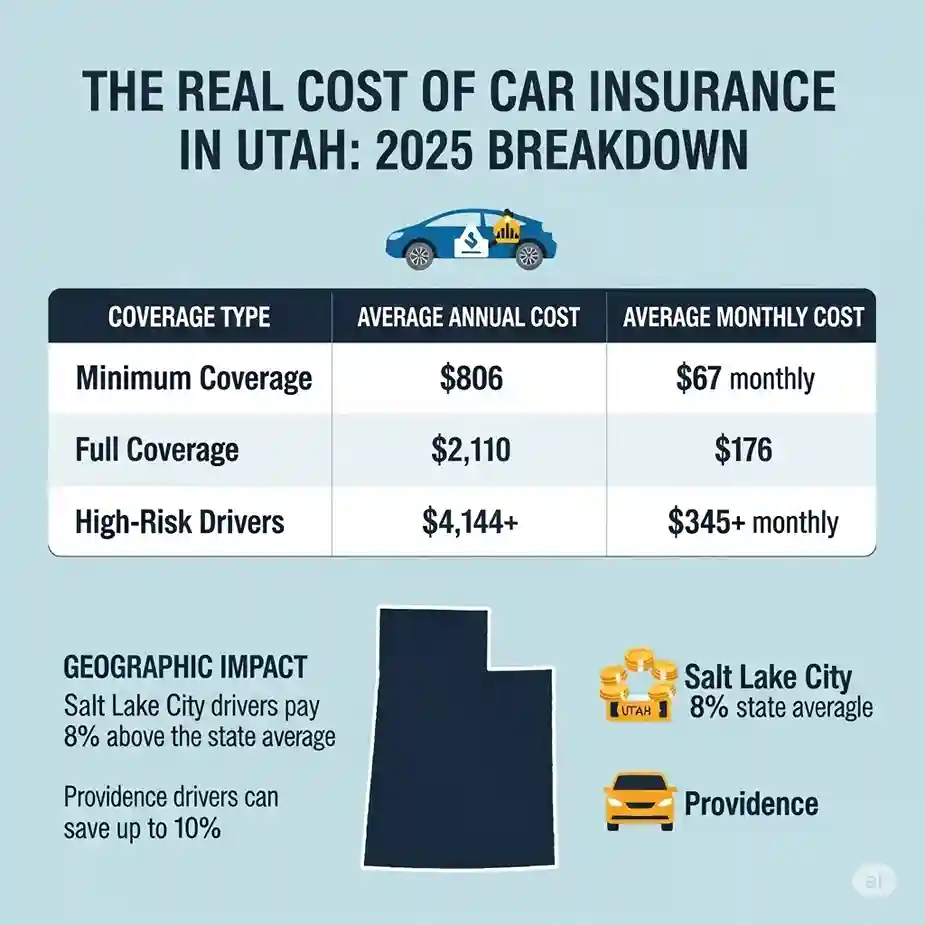

How Much More Does Full Coverage Cost in Utah?

- Liability that is required by law

- Collision insurance (for at-fault collisions)

- A comprehensive protection (for loss, weather and fire)

Average Costs (2025 Estimates)

| Coverage | What It Pays | Included in Minimum? |

|---|---|---|

| Bodily Injury Liability |

|

Yes |

| Property Damage Liability |

|

Yes |

| PIP (No‑Fault) |

|

Yes |

| Collision | Your car repairs after at‑fault crash | No |

| Comprehensive | Theft, vandalism, hail, animals, flood, fire | No |

How to Compare Coverage Options the Smart Way

- Determine what you want to cover: Only liability? Complete protection? Any extras?

- Request multiple quotes: Prices differ widely between Utah service providers.

- Make adjustments to your deductibles. A higher deductible could lower the cost of your plan.

- For discounts, ask about a good driver who has low mileage or a bundle discount.

- Recheck every six months or so: In particular, if you experience changes in your lifestyle or driving habits have changed.

Start with looking at car insurance quotes within Salt Lake City to find out which insurance policies provide the most value and security.

Conclusion

Utah's minimum auto insurance requirements are legally enforceable, however for many Salt Lake City drivers, the coverage isn't the ideal. A serious crash can quickly exceed the state's limits and leave you with many thousands of repairs in medical bills, repairs, or legal demands.

If the car, your finances and commute concern you, it could be the time to reconsider what "minimum" really means. A new insurance policy now can help you avoid major loss later on.